property tax on leased car in ri

Here are some charges you can expect from the Rhode Island DMV. However its more common to pay sales tax across each monthly lease payment.

Since NMAC is the legal owner of the vehicle the tax bill is paid immediately upon receipt.

. This applies to passenger vehicles. This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease. Rhode Island collects a 7 state sales tax rate on the purchase of all vehicles.

Arkansas Connecticut Kentucky Massachusetts. 401-456-9550 Page 1 Understanding Rhode Islands Motor Vehicle Tax March 2017 Summary of. Heres an explanation for.

State leaders announced Thursday they plan to eliminate the much-derided Rhode Island motor vehicle excise tax this. To discuss additional details regarding the property tax bill please contact Customer Service by. By Matthew Nesto.

WPRI Goodbye car tax. 600 Mount Pleasant Avenue Building 9 Providence RI 02908 ph. The fee amount ranges from.

Since IFS is the legal owner of the vehicle the tax bill is paid immediately upon receipt. For instance if your lease payment ends up being 500 a month and the leased car sales tax. Published 14 years ago by G.

In addition to taxes. While Rhode Islands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Based on vehicle weight prorated plus 250 plus 15 DOT charge per.

These Chapters provide for Sales and Use Tax Liability and Computation. So if you live in a state with a. New or used vehicles sales tax is 7 of the purchase price minus trade-in and other allowances.

This regulation implements Chapters 44-18 44-181 and 44-19 of the Rhode Island General Laws. This tax was to be completely eliminated in 2023 however. Law360 September 4 2019 710 PM EDT -- A Rhode Island attorneys seven-year lawsuit seeking a refund of sales tax he had paid on property taxes.

For additional information please contact Division of Motor Vehicles Dealers License and Hearing Board at 600 New London Avenue Cranston RI 02920 401 462-5731. Sales tax is a part of buying and leasing cars in states that charge it. In California the sales tax is 825 percent.

A documentation fee doc fee is typically charged by dealers as a kind of administrative fee for both purchased and leased vehicles. Like with any purchase the rules on when and how much sales tax youll pay. This may be a one-time annual payment or it may.

Property Tax Included in Leased Vehicle Sales Price in Rhode Island. For additional information please contact Division of. To discuss additional details regarding the property tax bill please contact Customer Service by.

In 2017 the General Assembly passed House Bill 5157 Article 11 which calls for the phase-out of the motor vehicle excise tax. This page describes the taxability of. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum.

Cars of Particular Interest CPI Dealer. For vehicles that are being rented or leased see see taxation of leases and rentals. If you didnt already know the following states apply a Personal Property Tax on all leased vehicles.

857 Main Rd Tiverton Ri 02878 Realtor Com

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

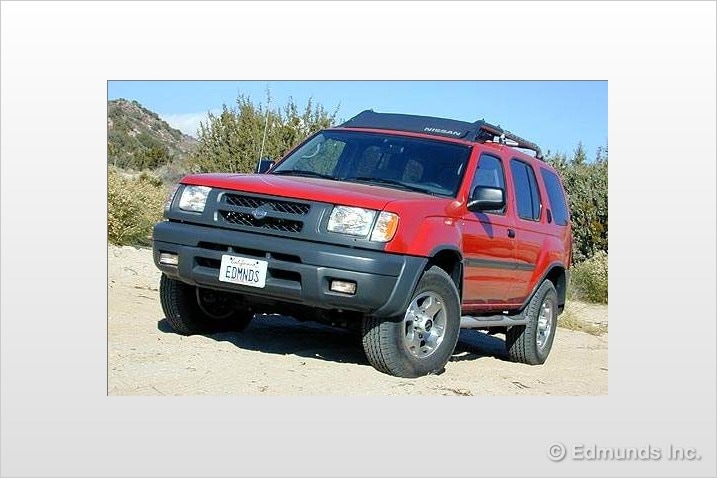

Sales Tax On Cars And Vehicles In Rhode Island

Bmw Lease End Information Bmw Usa

Do You Need A Certain Credit Score To Lease A Car Student Loan Hero

214 Waterman Ave East Providence Ri 02914 Realtor Com

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Leasing Vs Financing A Car 9 Questions To Ask Geico Living

What S The Car Sales Tax In Each State Find The Best Car Price

Motor Vehicle Taxability Exemptions And Taxability Department Of Taxation

Tangible Personal Property State Tangible Personal Property Taxes

510 E Main Rd Middletown Ri 02842 Loopnet

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

Nbc 10 I Team Drivers Who Lease Cars Complain Of Double Tax Wjar

Rhode Island House Approves Accelerated Phase Out Of Car Taxes For East Providence Residents City Of East Providence Ri

What S The Car Sales Tax In Each State Find The Best Car Price

Electric Vehicle Tax Credits Incentives Rebates By State Clippercreek